I hope this isn't too controversial, but I'm genuinely interested in people's thoughts.

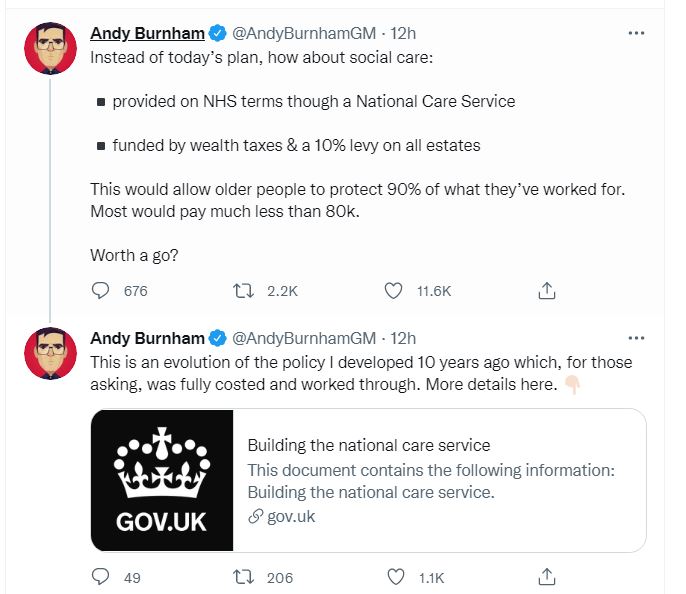

We can bash the rich, but I'm just not sure about the current system either with many people not making a contribution at all.

32M people pay income tax in the UK, broken down as :

27M people at lower rate, 4M at higher rate, 0.4M at additional rate and 0.7M at Savings rate.

The UK population is approx 67M

And working age population is 63% of that.

So that's 42M

potential tax payers and only 32M paying into taxation.

There are obvious reasons why some can't work and therefore not contribute taxes.

eg 8.4M people of working age have disabilities (but 53.6% (4.5M) of them are in work)

So why are around 5M people not contributing income tax at all ? (feel free to correct the maths, and I know a proportion will choose not to work)

e.g. Someone working 30 hours a week at £8.21/hour is paying zero income tax

As for national insurance, a worker at the same £8.21 rate does not contribute personally until

22 hours of work per week (edit : 14 hours, then contributions start at £2.85/week)

This is not down to the employee as this is the system we have, but is it fair?

At low pay rates and limited hours any additional taxation is a challenge, but should we all make 'some' contribution if we are fit and able to?

I do pay tax, but I'd be uncomfortable with the idea of relying on the rest of society to pay my share in different circumstances.

Is it right to move the burden to the rest of 'us', to allow employers to pay less than adequate levels of pay?

If any business cannot afford to pay people a sensible living wage, where they can make a contribution to taxation, it's not a business that should exist.

And if that means we all have to pay a bit more for goods and services, then that's what's needed.

Tell my why I'm wrong. No fighting please.

Sources

https://www.gov.uk/government/stati...ome-taxpayers-by-marginal-rate-gender-and-agehttps://data.oecd.org/pop/working-age-population.htmhttps://researchbriefings.files.parliament.uk/documents/CBP-7540/CBP-7540.pdf